Top Headlines – Key Global Developments

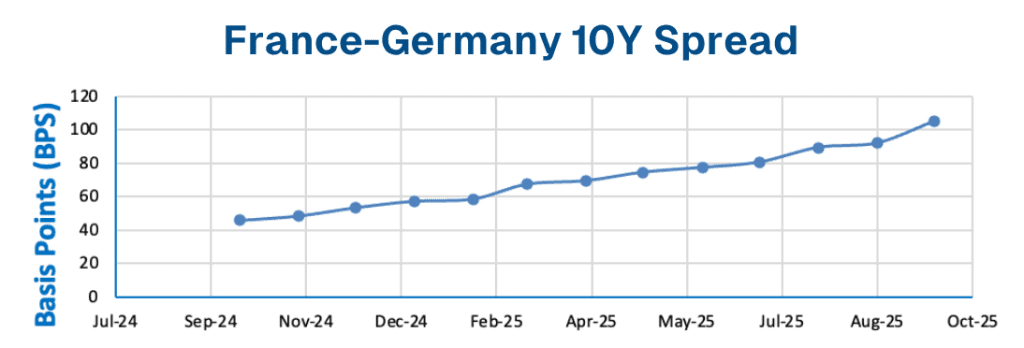

- France’s PM Lecornu resigns after failed budget talks, sending CAC 40 down 2% and widening the France–Germany yield spread to a 2025 high

- OPEC+ signals modest 65k bpd production increase for November; Brent rebounds above $65 as supply expectations tighten

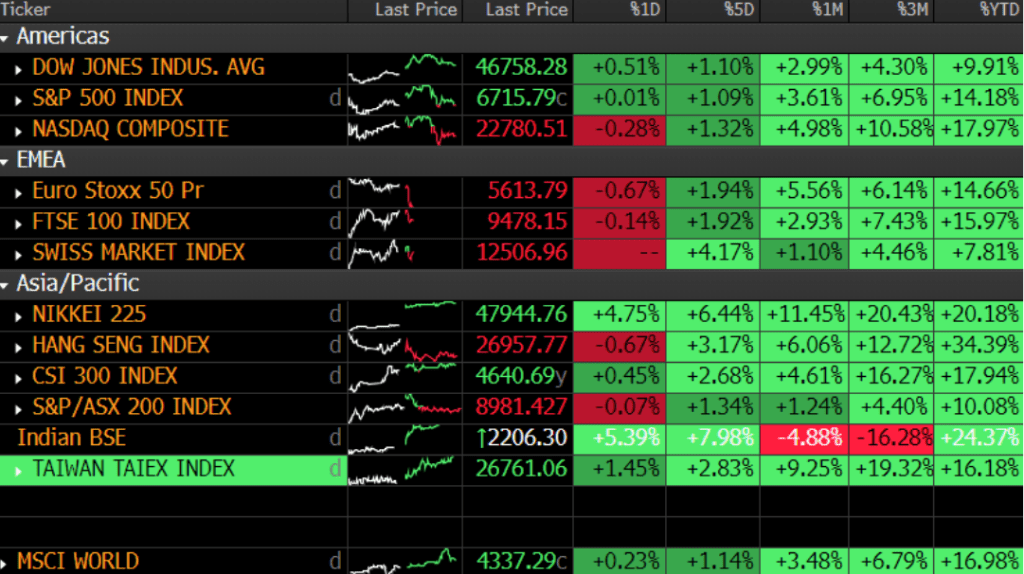

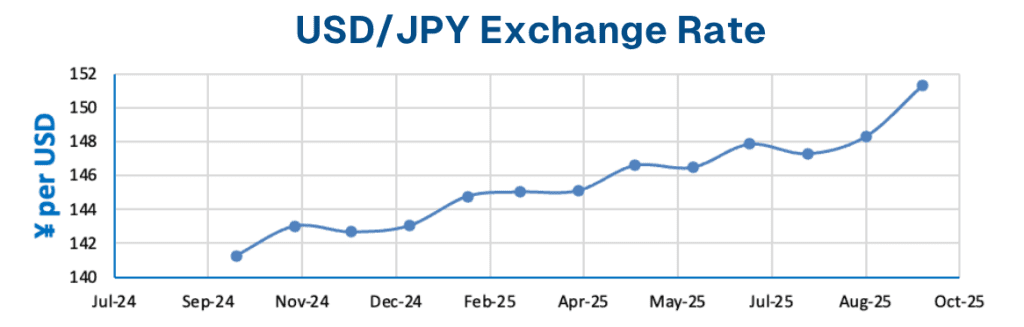

- Japan’s pro-stimulus LDP win drives Nikkei to new 2025 highs and pushes yen beyond ¥150 per dollar

- US government shutdown risks persist as spending talks stall; long-duration Treasuries rally on safe-haven flows

Markets Snapshot – Monthly and YTD Performance

United States – What’s Moving Markets

- Government shutdown risk intensifies with no funding agreement ahead of Oct. 11 deadline

- Payrolls data revised lower; unemployment steady at 4.3% supports case for sustained Fed easing bias

- Sentiment is shaped by safe-haven Treasury demand amid shutdown fears, weaker labor data, and a dovish repricing of Fed expectations. Equities remain resilient but breadth narrows as investors favor defensive sectors

Middle East – Market Sensitivities and Geopolitical Risks

- Israel–Palestine diplomatic isolation deepens as more Western allies recognize Palestine

- Oil markets digest OPEC+ output adjustment; Gulf sovereigns maintain issuance plans despite price volatility

- Iran warns of renewed uranium enrichment if sanctions persist

- Regional sentiment reflects contained oil volatility but elevated political risk premia. Investors are selectively long Gulf credit while remaining underweight high-beta regional equities

Europe – Key Drivers and Sentiment Shifts

- France’s Lecornu resigns following parliamentary deadlock, triggering selloff in French assets and sovereign spread widening

- ECB officials reiterate that inflation remains “too high,” though markets continue to price rate cuts by Q1 2026

- German retail sales rise modestly while UK mortgage approvals hit a three-year low

- Regional sentiment is dominated by political instability in France, widening sovereign spreads across southern Europe, and renewed inflation stickiness. Investors are rotating toward core sovereigns and reducing peripheral exposure as ECB policy credibility faces scrutiny

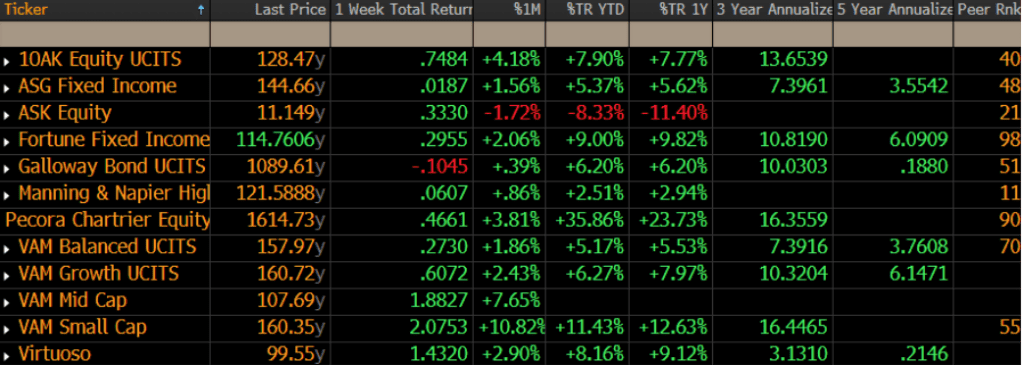

SailWealth Fund Performance

Asia-Pacific – Trade Momentum and Strategic Shifts

- Japan’s Takaichi secures LDP leadership, pledging fiscal stimulus and structural reforms; yen weakens beyond ¥150

- China markets reopen post-Golden Week with cautious tone; offshore funds continue rotating back into mainland equities

- South Korea’s chip exports rebound 6.5% YoY, adding to tech-driven optimism across the region

- Sentiment is shaped by renewed investor interest in Chinese assets as “uninvestable” perceptions fade, pro-stimulus optimism in Japan, and selective strength in tech-export economies. Regional positioning is tilting constructive despite global macro caution

South America – Trade Positioning and Political Realignment

- Argentina’s bonds extend rally after US confirms talks on $20 B swap line; peso stabilizes

- Brazil industrial output slips 0.4% MoM while inflation remains subdued

- Chile copper exports rebound as port disruptions ease

- Regional sentiment is buoyed by Argentine stabilization prospects, steady Brazilian inflation, and commodity flow normalization in Chile. Sovereign spreads continue to tighten selectively across the region

Australia – Steady Gains Amid Global Sensitivity

- RBA holds policy rate at 3.60% and signals openness to easing in November

- Fiscal balance improves as resource revenues surprise to the upside

- ASX 200 edges higher led by financials and energy; housing remains robust despite global headwinds

- Sentiment is supported by stable domestic macro conditions, firm fiscal data, and a dovish RBA bias. Investor positioning remains moderately risk-on within a defensive framework

Gold Nears $4,000 on Haven Demand

Gold extended gains toward $4,000 as investors sought havens amid Fed uncertainty and rising global debt fears

Yen Weakens Beyond ¥150 After LDP Win

The yen slid beyond ¥150 per dollar after Japan’s pro-stimulus LDP victory reinforced expectations of continued policy easing

France–Germany 10Y Yield Spread at 2025 Highs

France’s political instability widened the France–Germany spread to its highest level of 2025, underscoring fiscal stress and ECB credibility concerns